The Association of Mobile Money and Bank Agents in Nigeria (AMMBAN) has blamed operators in the financial services ecosystem for the proliferation of unlicensed point of sale terminal (POS) agents also known as ‘umbrella’ agents, which, according to them, has brought great disrepute to the operations in the country.

According to AMMBAN, the ‘umbrella’ agents that are not legally registered and have allowed several frauds to be perpetrated through them.

Speaking in Lagos, at the Sixth National Conference of the association with the theme: “Agency Banking in the Digital Age: Enforcing Standard, Seizing Opportunities and Managing Risks,” the President, Olojo Victor, in his welcome address, said the association would no longer tolerate activities of those tarnishing the image of the body and therefore urge for certification of agents in the ecosystem.

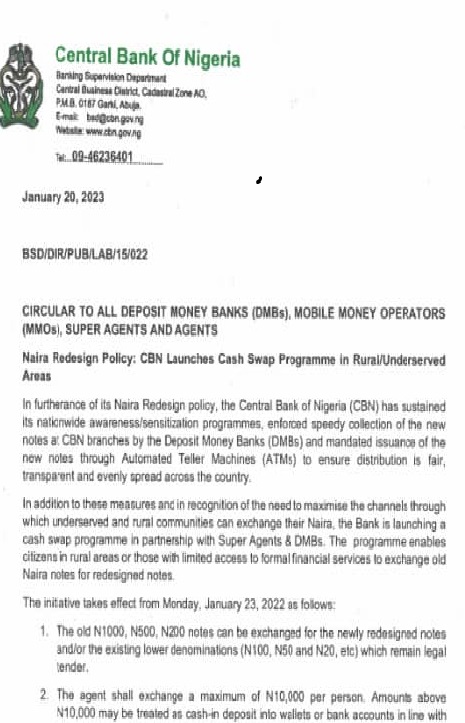

Tackling this menace headlong, Victor said AMMBAN would be working with the Central Bank of Nigeria (CBN), the Shared Agent Network Expansion Facility (SANEF), Lagos State Residents Registration Agency (LASRRA) and operators to ensure only agents registered are allowed to operate in the country.

“We are also working with the operators, we have Association of Licensed Mobile Payment Operators present at this event. We have been working together, the financial industry is huge as such we have companies that are issuing out POS and they are not licensed directly by the central Bank of Nigeria.

“Those companies most times don’t follow the rule established by the CBN. Because they have API which enables them to start issuing out POS to recruited agents without following CBN guideline. We are working with the association of operators that gives out the links for POS to work on the network to fish out those companies that are not following the standard rules given by CBN,” he said.

Speaking on year 2022 operations, Victor, who said there are currently 1.4 million registered agents under AMMBAN and hopes to increase the number, said the year has been a phenomenal one for agents and the industry at large as there have been significant events that shaped the sector.

According to him, registered PoS agents have reduced the rates of unemployment in the country because it has created job opportunities and boosted the economy.

He said: “Most significant is the quantum leap in the aggregate number of new mobile money and bank agents we have in the market space as of today.

According to the Nigeria Inter-Bank Settlement System Plc (NIBSS), in the last nine months of this year 2022, Nigerians spent a total of N6.05 trillion through the PoS, which is almost the same amount recorded in the year 2021, the total figure stood at N6.4 trillion.

“NIBSS said the volume of transactions on PoS went up as it increased by 14 per cent year on year to 100.4 million in September 2022,” he stated.

According to him, that feat was not without challenges. The AMMBAN President said the association had a spate of challenges some of which includes the cost of running business, delays in the reversal of failed transactions, network issues, bank/customers problems, insecurity, poor power supply, among others.

Victor, who described the theme of this year’s conference as very apt and befitting for this present time, said agency banking has indeed evolved with the impressive growth being recorded, it has become expedient for us all to sit and discuss issues around proper regimentation, standardization and seizing opportunities within the business space.

In his Keynote Presentation on the theme of the conference, Head, Department of Strategy, Lagos Business School, Prof. Olawale Ajai, said agency banking doesn’t go without security risks, although such may be reduced by avoiding holding too much cash at once.

Ajai said to curb the menace of agents tarnishing the image of AMMBAN, the regulator needs to work with the association.

According to him, there is a need to make the ‘umbrella’ agents become members of AMMBAN to ensure improved services. He stressed the need to take the services to rural areas to ensure the unserved and underserved communities are captured adequately well.